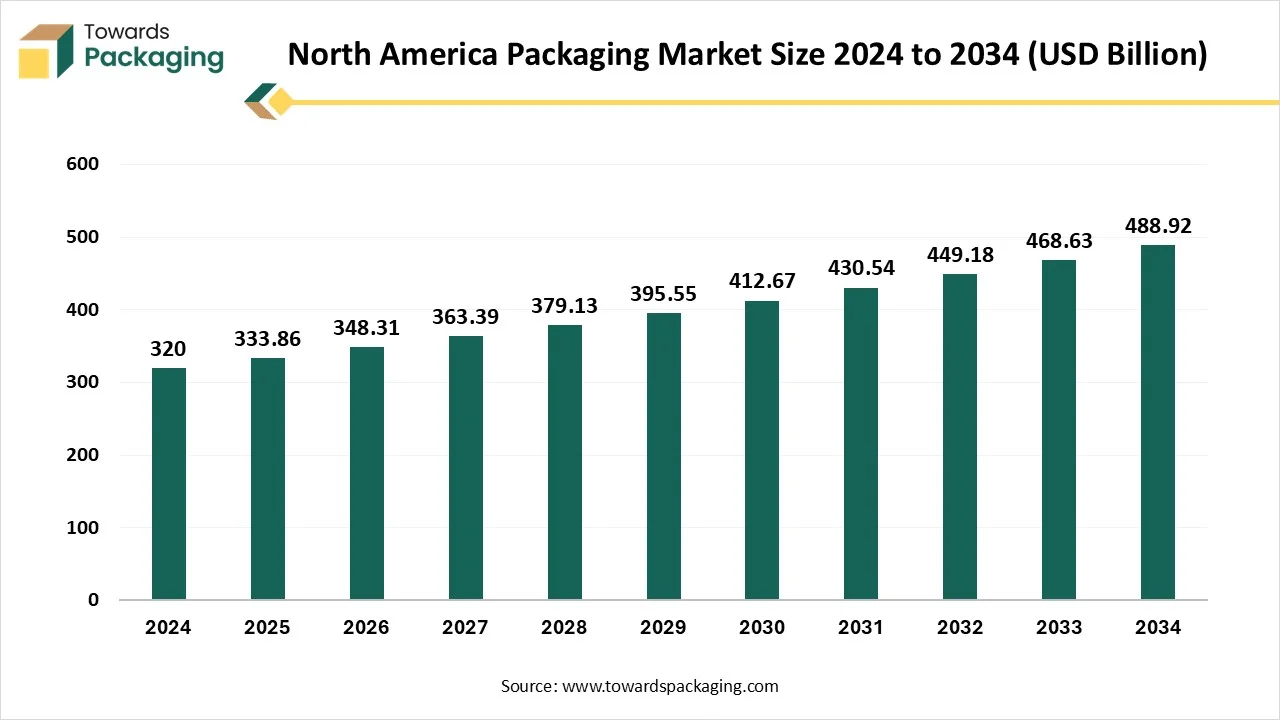

North America Packaging Market Worth USD 488.92 Bn by 2034

According to researchers from Towards Packaging, the global North America packaging market, estimated at USD 333.86 billion in 2025, is forecast to expand to USD 488.92 billion by 2034, growing at a CAGR of 4.33% over the forecast period.

Ottawa, Oct. 07, 2025 (GLOBE NEWSWIRE) -- The global North America packaging market size was recorded at USD 333.86 billion in 2025 and is forecast to increase to USD 488.92 billion in 2034, as per findings from a study published by Towards Packaging, a sister firm of Precedence Research.

The North America packaging market is driven by rising demand for sustainable, lightweight, and innovative packaging solutions across industries such as food and beverages, healthcare, personal care, and e-commerce. Companies are increasingly focusing on eco-friendly materials, recyclable packaging, and digital printing technologies to meet consumer preferences and regulatory requirements.

The U.S. dominated the market due to its strong manufacturing base, advanced technology adoption, and high consumption levels. Growth in online retail and increasing consumer awareness about product safety are further fueling market growth.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What is meant by Packaging?

Packaging refers to the process of designing and enclosing products in protective materials to ensure their safety, quality, and usability during storage, transportation, and distribution. It serves multiple purposes, such as preserving the product, preventing damage, extending shelf life, and providing essential information through labels. Packaging also plays a crucial role in branding and marketing by making products visually appealing and recognizable. It can be primary, secondary, or tertiary, depending on its function, and contributes significantly to consumer convenience and product value.

What are the Latest Trends in the North America Packaging Market?

1. Focus on Sustainability

Brands are rapidly shifting to recyclable, compostable, and lower-carbon materials, plus design-for-recycling practices. Companies are also investing in life cycle thinking and material substitution (paper, mono-plastics, biopolymers) to meet consumer and investor pressure.

2. Extended Producer Responsibility (EPR) and Tighter Regulations

New state and regional rules (reporting, recycling targets, fees) are forcing manufacturers and retailers to redesign packaging and plan end-of-life solutions accelerating sustainable redesign and compliance costs.

3. E-commerce Growth

Growth in online shopping is increasing demand for parcels that protect goods while minimizing void fill and dimensional weight fees. Right-sized boxes, protective paper fills, and reduced over-packaging are becoming standard to cut costs and waste.

4. Demand for Smart & Connected Packaging (RFID, Sensors, QR/IoT)

Adoption of RFID tags, freshness indicators, NFC/QR codes and sensor-enabled packaging is rising for traceability, anti-counterfeit, cold-chain monitoring, and consumer engagement. These techs help brands track goods, guarantee safety, and offer interactive experiences.

5. Automation and On-Demand/Robotic Packaging Solutions

Automated case-forming, on-demand box making, and robotic packing lines increase throughput, reduce labor dependency, and enable exactly-sized packaging important for peak e-commerce seasons and labor shortages.

6. Recycled Content and Post-Consumer Material Uptake

More firms are specifying higher % post-consumer recycled content (PCR) in plastics and paper; procurement shifts, and supply-chain investments are needed to secure quality PCR at scale. This trend is driven by both regulation and consumer preference.

7. Refillable, Reusable and Subscription Packaging Models

To cut single-use waste and build loyalty, retailers/brands are piloting refill stations, reusable transport packaging, and take-back schemes, blending logistics changes with new product economics.

8. Consumer-Centric Design & Brand Storytelling

Packaging now doubles as a marketing touchpoint: clearer sustainability claims, scannable content (how-to, origin stories), and premium unboxing experiences help retention and drive direct-to-consumer sales.

9. Active & Modified-Atmosphere Packaging for Food/Drugs

Increased use of active packaging (oxygen scavengers, antimicrobial layers) and MAP technologies to extend shelf life and reduce food waste especially important for perishable e-commerce and cold-chain products.

10. Cost Management Via Material Innovation and Lightweighting

With volatile raw-material prices, companies are optimizing substrates, reducing layers, and designing thinner or mono-material structures to cut material and transport costs while maintaining protection.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5683

What Potentiates the Growth of the North America Packaging Market?

Rising E-commerce and Online Retail

The surge in online shopping has increased demand for protective and convenient packaging solutions. Companies are focusing on lightweight, right-sized, and durable materials to ensure safe delivery while reducing shipping costs and waste. The rapid rise of e-commerce and online retail has become a major growth driver for North America’s packaging market. The increasing volume of individual parcel shipments requires more protective, durable, and lightweight packaging solutions to ensure safe delivery.

At the same time, customer expectations around unboxing experiences, branding, and eco-friendly practices are pushing companies to adopt innovative designs and sustainable materials. Growth in online grocery, direct-to-consumer business models, and last-mile delivery services further amplifies the need for efficient and adaptable packaging, making e-commerce one of the most influential factors shaping the region’s packaging industry.

Limitations & Challenges in North America Packaging Market

High Raw Material Costs & Recycling Infrastructure Challenges

The key players operating in the market are facing issue due to recycling infrastructure challenges and high raw material costs, which has estimated to restrict the growth of the market. Fluctuating prices of paper, plastics, metals, and bio-based materials create cost pressures on manufacturers, reducing profitability and slowing adoption of innovative packaging. Limited and uneven recycling facilities across North America hinder circular economy goals, making it difficult for companies to meet sustainability targets.

Country Level Analysis

U.S. Market Trends

The U.S. dominated the North America packaging market in 2024 due to its highly developed manufacturing and retail sectors, advanced technological infrastructure, and strong e-commerce penetration. High consumer demand for packaged goods, including food, beverages, personal care, and pharmaceuticals, drives continuous innovation in packaging materials and designs. Additionally, the presence of major global packaging companies, robust logistics networks, and strong regulatory frameworks supporting quality and safety further strengthen the U.S. position. Sustainability initiatives and adoption of smart and automated packaging solutions also contribute to its market leadership.

Mexico Market Trends

Mexico is emerging as the fastest-growing country in the North America packaging market due to its expanding manufacturing sector, increasing foreign investments, and growing consumer base. The country benefits from a strategic geographic location, enabling efficient trade with the U.S. and other Latin American markets. Rising demand for packaged food, beverages, and personal care products, coupled with the adoption of modern packaging technologies and sustainable materials, is driving market growth. Additionally, government initiatives to support industrial development and infrastructure improvements further accelerate Mexico’s packaging industry expansion.

More Insights of Towards Packaging:

- North America High-Barrier Packaging Films Market Size and Growth Forecast - The North America high-barrier packaging films market is expected to increase from USD 11.01 billion in 2025 to USD 19.12 billion by 2034.

- Flexible Packaging for Beverage Market 2025 Asia Pacific Leads with 36% Share and North America Set for Strong Growth - The flexible packaging for beverage market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- North America Packaging Tape Printing Market Leadership in 2025 Reinforced by 3M, Shurtape, and UPM New Product Launches - The North America packaging tape printing market is predicted to expand from USD 19.13 billion in 2025 to USD 29.78 billion by 2034.

- North America Plastic Packaging Market 2025 Insights: Rigid Plastic Leads, Bioplastics Gaining Traction - The North America plastic packaging market is predicted to expand from USD 92.93 billion in 2025 to USD 123.92 billion by 2034.

- Connected Food Packaging Market 2025: North America Leads with 36% Share, Asia Pacific Poised for Fastest Growth - A revenue surge in the connected food packaging market is on the horizon, with growth expected to reach hundreds of millions by 2034.

- Smart Packaging for D2C Market 2025: North America Leads, Asia Pacific Grows Fastest - The smart packaging for D2C market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Smart Packaging for Retail & E-Commerce Market 2025: North America Leads, Asia Pacific to Grow Fastest by 2034 - The global smart packaging for retail & e-commerce market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- North America Corrugated and Folding Carton Packaging Market Drives at 1.47% CAGR (2025-34) - The North America corrugated and folding carton packaging market is projected to reach USD 42.5 billion by 2034, growing from USD 37.27 billion in 2025.

- North America Corrugated Packaging Market Drives at 2.72% CAGR (2025-34) - The North America corrugated packaging market is projected to reach USD 54.41 billion by 2034, expanding from USD 42.77 billion in 2025.

- North America Flexible Packaging Market Mergers & Green Innovations Fuel Growth - The North America flexible packaging market is expected to increase from USD 84.9 billion in 2025 to USD 123.07 billion by 2034.

- Plastic Bottles and Containers Market: North America Leads & Asia Pacific Accelerates - The plastic bottles and containers market is set to grow from USD 42.1 billion in 2025 to USD 59.6 billion by 2034, with an expected CAGR of 3.94%.

- North America Insulated Packaging Market Growth Drivers, Challenges and Opportunities - The North America insulated packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Pharmaceutical Composite Films and Bags Market Competitive Landscape & Future Outlook - The pharmaceutical composite films and bags market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

- Flexitank Market Drives at 23.65% CAGR (2025-34) - The flexitank market is forecasted to expand from USD 1.85 billion in 2025 to USD 12.53 billion by 2034, growing at a CAGR of 23.65% from 2025 to 2034.

-

Industrial Packaging Recycling Services Market Drives at 4.53% CAGR (2025-34) - The industrial packaging recycling services market is expected to increase from USD 67.76 billion in 2025 to USD 100.65 billion by 2034.

Segment Outlook

Material Type Insights

The plastic segment dominated the North America packaging market in 2024 due to its versatility, durability, and cost-effectiveness. It can be easily molded into various shapes and sizes, making it suitable for food, beverages, personal care, and pharmaceutical products. Plastics offer excellent barrier properties, lightweight characteristics, and resistance to moisture and chemicals, ensuring product safety and extended shelf life. Additionally, innovations in recyclable and bio-based plastics, combined with ease of mass production and convenience for consumers, reinforce plastic’s leading position in the region’s packaging industry.

The bioplastic segment is likely to grow at the fastest rate due to increasing environmental awareness and strict regulations on single-use plastics. Consumers and manufacturers are shifting toward eco-friendly, biodegradable, and compostable alternatives. Advancements in biopolymer technologies, coupled with rising demand for sustainable packaging in food, beverages, and personal care products, are driving rapid adoption and growth of the bioplastic segment.

Packaging Format Insights

The bottles & jars segment dominated the North America packaging market in 2024 due to their wide applicability across food and beverages, personal care, pharmaceuticals, and household products. Their ability to preserve product quality, ensure safety, and provide convenient storage makes them highly preferred by manufacturers and consumers. Glass and plastic bottles and jars offer durability, reusability, and compatibility with diverse contents, while also supporting branding through labels, shapes, and designs. Growing demand for ready-to-drink beverages, cosmetics, and packaged foods further reinforces this segment’s market leadership.

The pouches segment is expected to expand at the fastest rate in the coming years due to their lightweight, flexible, and convenient design, which reduces transportation costs and storage space. They offer excellent barrier properties, preserving freshness and extending shelf life for food, beverages, and personal care products. Rising consumer preference for on-the-go, single-serve, and eco-friendly packaging, along with innovations in resealable and recyclable pouches, is driving rapid adoption and growth of this segment.

Packaging Type Insights

The rigid packaging segment dominated the North America packaging market due to its strength, durability, and ability to protect products during storage and transportation. Widely used in food and beverages, personal care, pharmaceuticals, and household goods, rigid packaging provides excellent barrier properties and product safety. Materials like glass, metals, and hard plastics enable premium branding and high consumer appeal through customizable shapes and designs. Additionally, its reusability, recyclability, and compatibility with advanced filling and sealing technologies reinforce its leading position in the market.

The flexible packaging segment is expected to expand at the fastest rate in the upcoming period due to its lightweight, versatile, and cost-effective nature. It offers excellent barrier properties, extends product shelf life, and reduces transportation and storage costs. Increasing demand for convenient, on-the-go, and sustainable packaging solutions in food, beverages, and personal care products drives its rapid adoption.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Packaging Function Insights

The primary packaging segment dominated the North America packaging market because it comes into direct contact with products, ensuring their protection, safety, and quality. It is widely used across food and beverages, pharmaceuticals, personal care, and household products to prevent contamination, preserve freshness, and extend shelf life. Primary packaging also plays a crucial role in branding and consumer appeal through design, labeling, and convenience features. Its essential protective function, combined with versatility and adaptability to various materials, reinforces its leading position in the market.

The tertiary packaging is the fastest-growing segment in the market due to the rapid expansion of e-commerce, retail distribution, and logistics networks. It provides essential protection and consolidation for bulk handling, storage, and transportation of goods, ensuring products reach consumers safely and efficiently. Increased focus on supply chain optimization, lightweight and durable materials, and automation in packaging lines is driving its adoption. Additionally, businesses are prioritizing cost-effective, stackable, and standardized tertiary packaging solutions to enhance efficiency, reduce damage, and support sustainability initiatives.

Technology Insights

The aseptic packaging segment led the market in 2024, as this technology is widely used to preserve products, particularly food and beverages, by sterilizing both the product and its packaging separately before filling. This process ensures that the contents remain free from harmful microorganisms, extending shelf life without the need for refrigeration. Commonly used for products like milk, juices, soups, and ready-to-eat meals, aseptic packaging combines hygiene, convenience, and durability. Its ability to maintain product quality, reduce preservatives, and support long-term storage makes it an important segment in the North America packaging market.

The smart packaging/RFID segment is likely to grow at the fastest rate due to increasing demand for product traceability, anti-counterfeiting measures, and supply chain transparency. Integration of sensors, QR codes, and RFID tags enhances real-time monitoring, improves inventory management, ensures safety, and engages consumers, driving rapid adoption across food, beverages, and pharmaceuticals.

End-Use Industry

The food packaging segment dominates the North America packaging market due to high consumer demand for packaged and processed foods. It ensures product safety, freshness, and extended shelf life while supporting convenient storage and transportation. Additionally, attractive designs and labeling enhance brand appeal, making food packaging a critical and leading segment in the region.

The e-commerce & logistics segment is expected to expand at the fastest CAGR in the upcoming period due to the rapid rise in online retail and home delivery services. It demands durable, lightweight, and protective packaging that ensures safe transport and reduces damage. Increasing consumer expectations for convenient, sustainable, and visually appealing packaging further drives innovation and adoption in this segment.

Distribution Channel Insights

The B2B segment dominated the North America packaging market in 2024 due to large-scale industrial and commercial demand across food and beverages, pharmaceuticals, personal care, and manufacturing sectors. Businesses require bulk, standardized, and efficient packaging solutions for storage, transportation, and distribution, making B2B operations a major driver of the region’s packaging industry.

The e-commerce supply chain segment is expected to grow at the fastest rate over the projection period due to the exponential growth of online retail and direct-to-consumer sales. This segment requires packaging solutions that are lightweight, durable, and protective to ensure safe delivery during last-mile transportation. Additionally, consumer demand for convenient, sustainable, and visually appealing packaging drives innovation in materials and design. Automation, smart tracking, and supply chain optimization further enhance efficiency, reduce product damage, and support rapid fulfillment, making this segment a key growth driver in the region.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in North America Packaging Market:

- In July 2025, American Packaging Corporation announced plans to expand its Center of Excellence in Story City, Iowa. The expansion, set to break ground in October 2025 and complete by September 2026, will add state-of-the-art pouching capabilities and increased capacity to meet growing consumer demand for convenient packaging solutions.

- In an US$8.4 billion stock deal announced in 2024, Amcor agreed to acquire Berry Global Group, creating a combined consumer and healthcare packaging company with annual revenues of approximately US$24 billion. The acquisition, expected to close by mid-2025, aims to strengthen Amcor's position in the North American packaging market.

-

In June 2024, Amazon has initiated a transition from plastic air pillows to recycled paper fillers in its North American packaging operations. This move, part of Amazon's largest plastic reduction effort in the region, aims to eliminate nearly 15 billion plastic air pillows annually. The company has already replaced 95% of plastic air pillows with paper, aligning with its goals of minimizing packaging waste and prioritizing recyclable materials.

Access our exclusive, data-rich dashboard dedicated to the North America Packaging Market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access Now: https://www.towardspackaging.com/contact-us

North America Packaging Market Top Players

- Amcor plc

- WestRock Company

- International Paper Company

- Berry Global Inc.

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Ball Corporation

- Crown Holdings Inc.

- Graphic Packaging Holding Company

- Smurfit Kappa Group

- Reynolds Group Holdings

- Owens-Illinois Inc. (O-I Glass, Inc.)

- AptarGroup Inc.

- Tetra Pak International S.A.

- Silgan Holdings Inc.

- Huhtamaki Group

- Georgia-Pacific LLC

- Coveris Holdings S.A.

- Printpack, Inc.

North America Flexible Packaging Market Segments

By Material Type

- Plastic

- PET

- HDPE

- LDPE

- PP

- PS

- PVC

- Bioplastics

- Paper & Paperboard

- Virgin

- Recycled

- Metal

- Aluminum

- Steel

- Tinplate

- Glass

- Clear

- Colored

- Wood

- Others

- Textile-based

- Biodegradable composites

By Packaging Type

- Rigid Packaging

- Bottles

- Jars

- Cans

- Boxes

- Trays

- Cartons

- Flexible Packaging

- Pouches

- Sachets

- Wraps

- Blisters

- Films

- Foils

- Semi-Rigid Packaging

- Tubes

- Clamshells

- Blisters

By Packaging Function

- Primary Packaging

- Secondary Packaging

- Tertiary / Transit Packaging

By Technology

- Modified Atmosphere Packaging (MAP)

- Aseptic Packaging

- Anti-Counterfeit Packaging

- Active & Intelligent Packaging

- Vacuum Packaging

- Retort Packaging

- Tamper-Evident Packaging

- Smart Labels / RFID / QR Codes

By End-Use Industry

- Food

- Frozen

- Fresh

- Ready-to-eat

- Confectionery

- Dairy

- Snacks

- Beverage

- Alcoholic

- Non-alcoholic

- Dairy

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Industrial

- Lubricants

- Construction Materials

- Paints

- E-commerce & Logistics

- Household Products

- Agriculture & Chemicals

- Automotive

- Others

- Textiles

- Electronics

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5683

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging, Your Trusted Research and Consulting Partner, Has Been Featured Across Influential Industry Portals - Explore the Coverage:

- Flexible Packaging Market - PACKNODE

- Is it finally safe to ditch your phone case? I put it to the test

- Battery Brands Charge Forward with Plastic-Free Packaging

- Why Non-corrugated Boxes Are the Future of Packaging

- Ampoules Packaging Market Size Expected to Reach $11.27 Bn by 2034

- Flexible plastic pouches projected to boom over the next decade

- GLOBAL PET FOOD PACKAGING MARKET SET TO DOUBLE BY 2032

- The Skinny on the Skin Packaging Market

- Healthcare Goes Green & Sterile

- The Different Types of Adhesives for Paper Packaging

-

Child-Resistant Packaging: Cannabis and So Much More

Towards Packaging Releases Its Latest Insight - Check It Out:

- AI in Sustainable Packaging Market Drives at Strong CAGR

- Trolley Bags Market Drives at 5.85% CAGR (2025-34)

- Germany Flexible Packaging Market Drives at 4.25% CAGR (2025-34)

- Multilayer PET Bottles Market Drives at 5.93% CAGR (2025-34)

- Folding Cartons Market Size Drives at 5.46% CAGR (2025-34)

- PVC Packaging Film Market Drives at 2.43% CAGR (2025-34)

- High-Density Polyethylene (HDPE) Bottles Market Driven by 4.26% CAGR

- Multilingual Packaging Market Insights, Forecast and Competitive Strategies

- Volume-Optimized Corrugated Packaging Systems Market Size & Share

- Plastic Corrugated Sheets Market Drives at 5.34% CAGR (2025-34)

- Corrugated Fanfold Market Driven by 3.85% CAGR (2025-34)

- Shaped Corrugated Packaging Market Drives at 4.9% CAGR (2025-34)

- Old Corrugated Container Market Drives at 4.9% CAGR (2025-34)

- Corrugated Bulk Bin Market Drives at 5.2% CAGR (2025-34)

-

Corrugated Wraps Market Drives at 4.80% CAGR (2025-34)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.