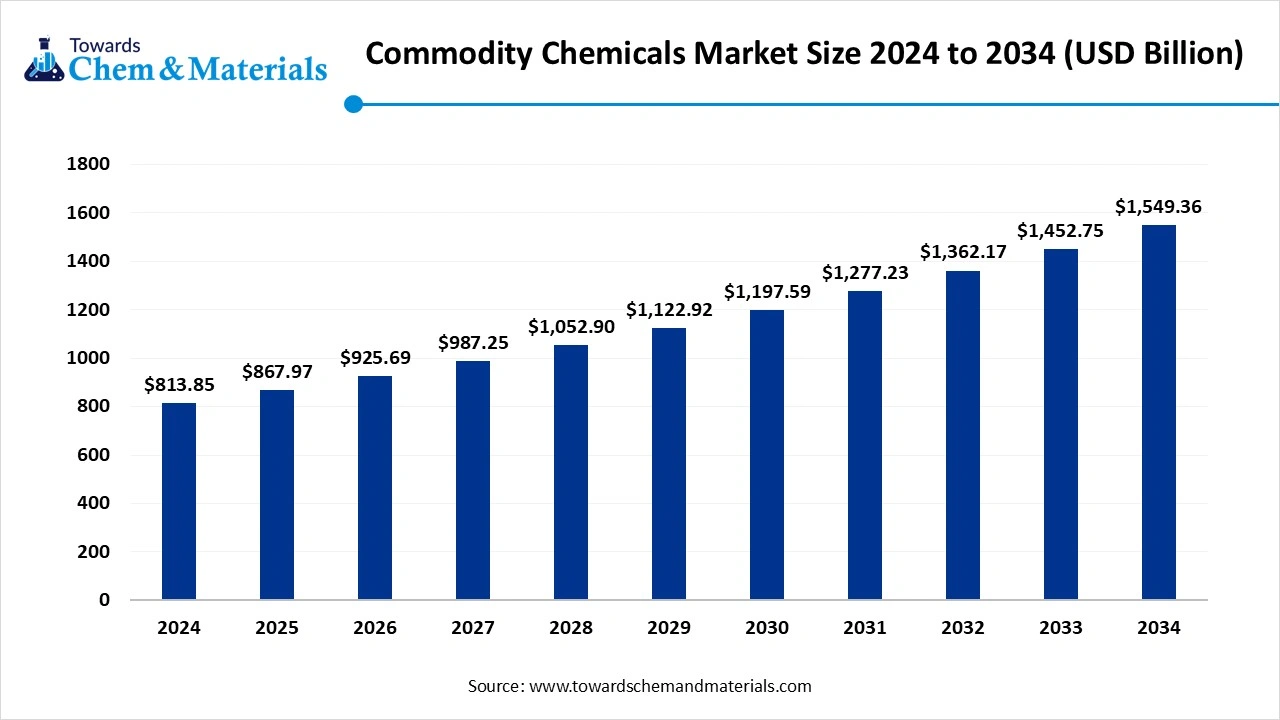

Commodity Chemicals Market Size to Worth USD 1,549.36 Billion by 2034

According to Towards Chemical and Materials, the global commodity chemicals market size is calculated at USD 867.97 billion in 2025 and is expected to be worth around USD 1,549.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period 2025 to 2034.

Ottawa, Oct. 06, 2025 (GLOBE NEWSWIRE) -- The global commodity chemicals market size was valued at USD 813.85 billion in 2024 and is anticipated to reach around USD 1,549.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5877

Commodity Chemicals Overview:

The commodity chemicals market encompasses large-volume, standardized chemicals that serve as primary building blocks across multiple industries and regions. It is driven by demand from sectors such as construction, automotive, packaging, agriculture, and consumer goods. Innovations in feedstock sourcing are shifting the industry toward alternative inputs like biomass, CO2 and municipal waste to reduce reliance on fossil fuels. Meanwhile, technological developments such as AI driven reaction optimization and bio-integrated petrochemical hybrids are reshaping production methods. Regional dynamics show strong dominance by Asia Pacific, supported by industrial activity and favourable policies, while growth is expected in regions with abundant hydrocarbon feedstock. On the supply side, large integrated players maintain strength through scale, while smaller specialty and bio-based players are gaining traction in niche areas.

Commodity Chemicals Market Report Highlights

- The Asia Pacific commodity chemicals market size was estimated at USD 398.79 billion in 2024 and is projected to reach USD 760.27 billion by 2034, growing at a CAGR of 6.67% from 2025 to 2034. Asia Pacific dominated the market in 2024,

- By region, Asia Pacific dominated the market with approximately 49% industry share in 2024.

- By product type, the petrochemical segment led the market with approximately 46% industry share in 2024.

- By raw material, the crude oil segment emerged as the top-performing segment in the market with approximately 54% industry share in 2024.

- By manufacturing process, the steam cracking segment led the market with approximately 39% share in 2024.

- By industry vertical, the construction and infrastructure segment emerged as the top-performing segment in the commodity chemicals market with approximately 31% industry share in 2024.

- By enterprise size, the large enterprises segment led the market with approximately 64% share in 2024.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5877

Commodity Chemicals Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 925.69 billion |

| Revenue forecast in 2034 | USD 1,549.36 Billion |

| Growth rate | CAGR of 6.65% from 2025 to 2034 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

| Report Segmentation | By Product Type, By Raw Material, By Manufacturing Process, By Industry Vertical (End-Use), By Enterprise Size, By Region |

| Key companies profiled | BASF SE , Dow Chemical Company , SABIC, LyondellBasell Industries , ExxonMobil Chemical , INEOS Group, Sinopec , Reliance Industries Limited (RIL) , Mitsubishi Chemical Group, Formosa Plastics Group, Covestro AG , Borealis AG , LG Chem , DuPont de Nemours, Inc. , PTT Global Chemical, Arkema S.A. , Braskem S.A. , Chevron Phillips Chemical , Yara International (fertilizer & nitrogen chemicals) , Mitsui Chemicals |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some Of The Top Products On The Commodity Chemicals Market

- Ethylene- Key raw material for polyethylene, ethylene oxide, ethylene dichloride, etc.

- Propylene- Used in polypropylene, acrylonitrile, propylene oxide, and cumene production.

- Methanol- Feedstock for formaldehyde, acetic acid, MTBE, and as an alternative fuel.

- Ammonia- Vital for fertilizer production (urea, nitrates), explosives, and cleaning products.

- Benzene- Base for making styrene, phenol, aniline, and detergents.

- Toluene- Used in solvents, benzene production, and making toluene diisocyanate (TDI).

- Xylenes (e.g., PX)- Para-xylene used in producing PET (polyester), essential for textiles and bottles.

- Polyethylene (PE)- Most widely used plastic, used in packaging, films, containers, etc.

- Polypropylene (PP)- Durable plastic used in automotive parts, packaging, textiles, and more.

- PVC (Polyvinyl Chloride)- Used in pipes, cables, construction materials, and medical devices.

What Are The Major Trends In The Commodity Chemicals Market?

- Shift toward alternative feedstock such as biomass, agricultural waste, and CO2 to reduce reliance on fossil fuels.

- Integration of AI driven reaction optimization and digital tools to enhance process efficiency.

- Emergence of bio-integrated petrochemical hybrids as transitional solution between fossil and fully bio-based chemistries.

- Growth of modular and localized production systems to reduce logistics cost and carbon footprint.

How Does AI Influence the Growth of the Commodity Chemicals Market In 2025?

In 2025, AI is set to act as a powerful enabler in the commodity chemicals market by optimizing reaction parameters and process conditions to heighten yields, diminish waste, and reduce energy usage. It will bolster predictive maintenance of equipment, catching early signs of malfunction before breakdowns occur and so improving uptime. In research and development, AI will accelerate molecular design and virtual screening, hastening the development of new formulations and alternatives fed-stocks. On the supply chain front, AI and machine learning will strengthen demand forecasting, logistics will strengthen demand forecasting, logistics planning, and risk mitigation, supporting more agile resilient operations.

Commodity Chemicals Market Growth Factors

Is Green Chemistry Becoming the New Competitive Edge?

Growing pressure from regulators and consumers is pushing chemical producers to shift from fossil-based inputs toward renewable feedstock such as agricultural waste, bio-oils, and captured carbon. This transition is no longer driven purely by ethics but by economies, as companies adopting circular production models often report lower long term operating risks and stronger bran positioning. Major chemical manufacturers have begun partnering with waste management firm and aggrotech start-ups to secure sustainable raw material pipelines. This collaboration is parking fresh investment in cleaner processing technologies that operate with lower emissions and fewer toxic by-products.

Will On-Site Manufacturing Transform Supply Stability?

Chemical producers are increasingly deploying modular production units closer to end use industries such as construction, agriculture, and packaging. This localized model reduces dependency on long-haul logistics, which has been a key vulnerability during recent geopolitical tensions and transportation disruptions. Instead of centralized mega-plants, companies are testing “distributed manufacturing” setups that can be rapidly scaled or reconfigured. This agility is attracting interest demo both private investors and government infrastructure programs aiming to stabilize supply chains.

Market Opportunity

Can Plastic Waste Become a Valuable Feedstock?

The growing push toward circular manufacturing is opening an opportunity for commodity chemical producers to convert plastic waste into reusable chemical building blocks. Technologies like pyrolysis and chemical depolymerisation are now being scaled by companies collaborating with packaging firms and municipal waste systems. Producers that invest early in this space stand to secure low-cost raw materials while meeting sustainability demands from regulators and brand owners. The shift also helps manufacturers reduce on crude derived naphtha without compromising product consistency.

Will Hydrogen Become the Next core Chemical Input?

The rise of low carbon hydrogen from electrolysis is giving chemical producers a fresh route to manufacture ammonia, methanol, and synthetic fuels with lower emissions. Governments across Europe, Asia and the Middle East offering infrastructure support, motivating industrial clusters to switch from conventional hydrogen derived from natural gas. Companies involved in refining and fertilizer production are already testing dedicated hydrogen derived from natural gas. Companies involved in refining and fertilizer production are already testing dedicated hydrogen networks to replace fossil-based inputs. This creates room for new suppliers, pipeline operators, and technology licensors to participate across the value chain.

Limitations In the Commodity Chemicals Market

- High dependence on volatile fossil-based feedstock exposes producers to raw material price swings and supply disrupts.

- Stringent environmental and safety regulations impose compliance burden and require costly investments in cleaner processes.

Commodity Chemicals Market Segmental Insights

Product Type Insights

Why Are Petrochemicals Segment Dominating in Commodity Chemicals Market?

The petrochemical segment dominated the market in 2024. Petrochemicals remain the backbone of the commodity chemicals industry sue to their versatility and widespread applications across multiple sectors including construction, packaging, automotive, and textiles. The dominance is reinforced by the extensive integration of petrochemical production facilities in major chemical hubs, which allows for large scale output and cost efficiency. As industries continue to rely on basic chemical building blocks for manufacturing, the demand for petrochemicals maintains strong momentum. Additionally, technological advancements in refining and processing help sustain the high-volume production required to meet global industrial needs.

The polymers and biobased chemicals segment are projected to experience the highest growth rate in the market between 2025 and 2034. The surge in demand is driven by industries seeking sustainable alternatives to traditional petrochemicals, fuelled by regulatory pressure and consumer preference for eco-friendly products. Investments in bio-based feedstock and advanced polymerization technologies are accelerating innovation and expanding production capacity. Companies are also exploring hybrid chemical solutions that combine conventional and bio-based feedstock and advanced polymerization technologies are accelerating innovation and expanding production capacity. Companies are also exploring hybrid chemical solution that combine conventional and bio-based polymers to reduce environmental impact while maintaining performance. The segment’s rapid growth is further supported by increasing applications in packaging, automotive, and consumer goods, where sustainability is becoming a key purchasing, automotive, and consumer goods, where sustainability is becoming a key purchasing criterion.

Raw Material Insights

Why Is Crude Oil the Key Raw Material?

The crude oil segment dominated the market in 2024. Crude oil continues to be the primary feedstock for the majority of commodity chemicals due to its abundance and established supply chain. The segment supports a wide variety of downstream products, from basic hydrocarbons to complex derivatives, ensuring its central role in chemical manufacturing. Strategic investments in refineries and petrochemical complexes further strengthen the dominance of crude oil as raw material. Moreover, global industrial processes remain largely dependent on crude-based inputs, making this segment indispensable to the market structure.

The biomass and renewable feedstock segment is set to experience the fastest rate of market growth from2025 to 2034. The trend toward sustainable production practices is encouraging chemical manufacturers to adopt renewable sources such as agricultural residues, bio-oils, and municipal waste. Innovations in processing technologies are enabling this feedstock to serve as viable alternatives to conventional crude, reducing the carbon footprint of production. Government incentives and regulatory support further accelerate adoption by mitigating costs and promoting research. The growing for eco-friendly chemicals in various end use industries underpins the rapid expansion of this segment.

Manufacturing Process Insights

Why Is Steam Cracking Leading?

The steam crocking segment dominated the market in 2024. Steam cracking remains the cornerstone of ethylene and propylene production, essential for various downstream chemicals. Its widespread adoption is due to its efficiency and scalability, making it the preferred method for large scale operations. The processes’ ability to produce a wide range of valuable products from hydrocarbon feedstock further cements its dominance. As industries continue to demand diverse chemical production steam cracking’s role is expected to remain pivotal.

The fermentation and bio-based process segment is anticipated to grow with the highest CAGR in the market during the studied years. This growth is driven by the increasing shift towards sustainable and renewable production methods. Fermentation processes, utilizing microorganisms, offer an eco-friendly alternative to traditional chemical synthesis. The rising demand for bio-based chemicals across various industries, including pharmaceuticals and food, further propels this segment’s expansion. As technological advancements continue, the efficiency and cost effectiveness of bio-based processes are expected to improve, fostering broader adoption.

Industry Vertical Insights

Why Is Construction and Infrastructure Segment Dominant In Commodity Chemicals Market?

The construction and infrastructure segment dominated the market in 2024. The demand for chemicals in this sector is driven by the need for materials like adhesives, sealants, and coatings essential for construction projects. Urbanization and infrastructure development globally have significantly contributed to the growth in this segment. The continues need for maintenance and renovation of existing structures also fuels the demand for construction related chemicals. As the construction industry expands, its reliance on specialized chemicals continues to grow, reinforcing its dominance in the market.

The automotive segment is projected to expand rapidly in the market in the coming years. The automotive industry’s shift towards lightweight materials and advanced coatings has increased the demand for specialized chemicals. Innovations in electric vehicles and autonomous driving technologies further contribute to the sector’s growth, requiring new chemical solutions. Additionally, stringent environmental regulations are pushing for the development of eco-friendly automotive components, boosting the demand for sustainable chemicals. As the automotive industry evolves, its need for specialized chemicals continues to rise, positioning it as a fast-growing segment.

Enterprise Size Insights

Why Do Large Enterprises Segment Dominated the Commodity Chemicals Market?

The large enterprises segment led the market in 2024. These companies benefit from economies of scale, extensive distribution networks, and significant research and development capabilities, allowing them to dominate the market. Their established brand presence and financial strength enable them to invest in advanced technologies and expand their global reach. Large enterprises also have the resources to comply with stringent regulatory requirements, ensuring consistent product quality and safety. As the market grows, the influence of large enterprises remains a defining factor in shaping industry trends and standards.

The SMEs segment is expected to capture the biggest portion of the market in the coming years. Small and medium-sized enterprises are increasingly adopting innovative technologies and agile business models to compete effectively. Their ability to quickly market. Additionally, the rise of digital platforms and e-commerce has enabled SMEs to reach a broader customer base, facilitating their growth. As they continue to innovate and expand, SMEs are set to crucial role in the evolving commodity chemicals market.

Regional Insights

Why Is Asia Pacific Dominating the Commodity Chemicals Market?

Asia Pacific dominated the commodity chemicals market in 2024, accounting for nearly half of the global share. This leadership is driven by robust industrial activity, particularly in sectors such as packaging, automotive, and agriculture. The region’s competitive advantage stems from access to low-cost feedstock, advanced manufacturing capabilities, and a growing demand for both bulk and specialty chemicals. Countries like China and India play pivotal roles in this dominance, contributing significantly to the region’s overall market share. The strategic investments in chemical infrastructure and adherence to evolving environmental standards further bolster Asia Pacific’s position in the global market.

China and India stand out as central figures in the market within Asia Pacific. China leads globally in chemical production and consumption, with a substantial share of the market. Its expensive industrial base and investments in advanced chemical manufacturing technologies solidify its position. India, in the other hand, ranks as the sixth largest producer of chemicals worldwide and in Asia, contributing significantly to the region’s market dynamics. The country’s chemical, petrochemicals, and fertilizers, with a substantial portion of production consumer domestically. Both nations strategic initiatives and industrial growth continue to shape the future of the commodity chemicals market in Asia Pacific.

Why Is Middle East and Africa Emerging as A Fast-Growing Hub in The Commodity Chemicals Market?

The Middle East and Africa (MEA) is experiencing rapid growth in the market during the forecast period, driven by abundant low-cost hydrocarbon feedstock and strategic investments in chemical productions indicating a notable increase in market share from 2025 to 2034. The region’s growth is further supported by the rise in industrial activities, including the production of fertilizers, coatings, and specialty chemicals, which are essential for sectors such as agriculture, construction, and automotive. Additionally, the MEA’s chemical distribution market is poised for growth, with Saudi Arabia expected to register the highest compound annual growth rate (CAGR) from 2023 to 2030. This upward trajectory positions the MEA as a significant player in the global commodity chemicals market.

More Insights in Towards Chemical and Materials:

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Waterproofing Chemicals Market : The global waterproofing chemicals market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.39 billion in 2025 to approximately USD 15.23 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034.

- Flame Retardant Chemicals Market : The global flame retardant chemicals market size was estimated at USD 7.85 billion in 2024 and is expected to hit around USD 13.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.65% over the forecast period from 2025 to 2034.

- Specialty Chemicals Market : The global specialty chemicals market size is calculated at USD 671.19 billion in 2024, grew to USD 706.36 billion in 2025, and is projected to reach around USD 1,118.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

- Textile Chemicals Market : The global textile chemicals market size was reached at USD 30.19 billion in 2024 and is expected to be worth around USD 50.84 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.35% over the forecast period 2025 to 2034.

- Electronic Materials and Chemicals Market : The global electronic materials and chemicals market size was valued at USD 74.19 billion in 2024 and is expected to hit around USD 136.03 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.25% over the forecast period from 2025 to 2034.

- Froth Flotation Chemicals Market : The global froth flotation chemicals market size was reached at USD 2.11 billion in 2024, is grew to USD 2.20 billion in 2025 and is expected to be worth around USD 3.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.45% over the forecast period 2025 to 2034.

- Lithium Chemicals Market : The global lithium chemicals market size was reached at USD 33.19 billion in 2024 and is expected to be worth around USD 196.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 50% over the forecast period 2025 to 2034.

- Bio-Based Platform Chemicals Market: The global bio-based platform chemicals market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

- PFAS Free Chemicals Market : The global PFAS free chemicals market volume was valued at 211.23 kilo tons in 2024 and is expected to reach around 905.32 kilo tons by 2034, growing at a CAGR of 15.67% from 2025 to 2034.

- Boiler Water Treatment Chemicals Market : The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034.

- Construction Chemicals Market : The global construction chemicals market size is calculated at USD 51.19 billion in 2024, grew to USD 53.02 billion in 2025 and is predicted to hit around USD 72.7 billion by 2034, expanding at healthy CAGR of 3.57% between 2025 and 2034.

- Agrochemicals Market : The global agrochemicals market size accounted for USD 285.36 billion in 2024 and is predicted to increase from USD 300.91 billion in 2025 to approximately USD 485.13 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034.

- Quetiapine Intermediate Chemicals Market : The global quetiapine intermediate chemicals market was valued at approximately 788.10 kilo tons in 2024 and is projected to grow at a CAGR of 4.28% from 2025 to 2034, reaching a value of 1198.80 kilo tons by 2034.

- Sludge Treatment Chemicals Market : The global phosphate fertilizers market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.30 billion in 2025 to approximately USD 13.65 billion by 2034, expanding at a CAGR of 6.55% from 2025 to 2034.

- GCC Specialty Chemicals Market : The global gcc specialty chemicals market size was valued at $ 36.89 billion in 2024 and is estimated to reach around USD 55.13 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.10% during the forecast period 2025 to 2034.

Commodity Chemicals Market Top Key Companies:

- BASF SE

- Dow Chemical Company

- SABIC

- LyondellBasell Industries

- ExxonMobil Chemical

- INEOS Group

- Sinopec

- Reliance Industries Limited (RIL)

- Mitsubishi Chemical Group

- Formosa Plastics Group

- Covestro AG

- Borealis AG

- LG Chem

- DuPont de Nemours, Inc.

- PTT Global Chemical

- Arkema S.A.

- Braskem S.A.

- Chevron Phillips Chemical

- Yara International (fertilizer & nitrogen chemicals)

- Mitsui Chemicals

Recent Developments

- In September 2025, U.S. tariffs are intensifying difficulties in the global petrochemical industry. Executives at the APPEC conference in Singapore warned that continued tariffs could recuse cause a further 15% drop in global petrochemical trade, adding to prior 34% decrease over the past five years due to overcapacity. Non asset owning petrochemical traders are specially struggling to stay afloat.

- In June 2025, Hindalco Industries, a subsidiary of the Aditya Birla Group, has announced the acquisition of U.S. based AluChem Companies Inc. for $125 million. This strategic move aims to bolsters Hindalco’s specialty aluminium portfolio by adding AluChem’s 60,000 tonne annual capacity across there U.S. facilities. The acquisition aligns with Hindalco’s strategy to expand its global footprint in value added, high margin speciality chemicals, targeting a production capacity of 1 million tonnes by Fy30.

Commodity Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Commodity Chemicals Market

By Product Type

- Petrochemicals (Ethylene, Propylene, Benzene, Toluene, Xylene)

- Basic Inorganics (Chlor-alkali, Sulfuric Acid, Nitrogen Compounds, Ammonia)

- Polymers (Polyethylene, Polypropylene, PVC, PET)

- Synthetic Rubber

- Dyes & Pigments

- Others (Solvents, Fertilizers, Adhesives, Explosives)

By Raw Material

- Crude Oil

- Natural Gas

- Coal

- Biomass & Renewable Feedstocks

By Manufacturing Process

- Steam Cracking

- Catalytic Reforming

- Fermentation & Bio-based Processes

- Electrolysis

- Others

By Industry Vertical (End-Use)

- Construction & Infrastructure

- Automotive & Transportation

- Packaging

- Agriculture & Fertilizers

- Textiles & Apparel

- Consumer Goods (Detergents, Cleaning Products)

- Electrical & Electronics

- Industrial Manufacturing

By Enterprise Size

- Large Enterprises (Integrated Chemical Giants)

- Small & Medium Enterprises (Regional/Local Players)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5877

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.